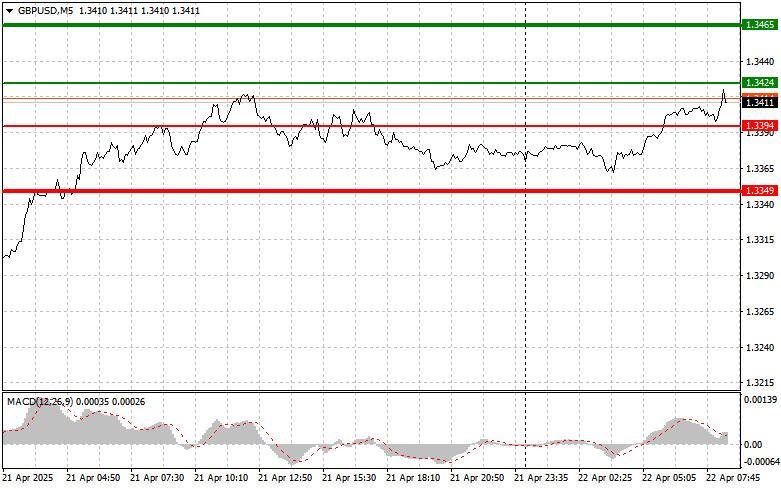

The price test at 1.3379 occurred when the MACD indicator had already moved far below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the pound. I also didn't see any other entry points in the market.

Yesterday's lack of data from the UK helped the pound continue its upward movement. The same scenario might repeat today, as no major macroeconomic indicators are expected.

However, it's unwise to rely solely on the absence of news. The currency market is unpredictable, and investor sentiment can shift due to external factors, including the US stance on trade tariffs. Don't forget that the pound is traded against the dollar, which is currently under heavy pressure from several angles: ongoing trade tariffs, inflationary risks, and Donald Trump's pressure on Jerome Powell to cut interest rates—something that, as you probably know, is negative for the dollar.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today at the entry point around 1.3424 (green line on the chart) with a target of 1.3465 (thicker green line). Around 1.3465, I plan to exit the buys and open short positions in the opposite direction (expecting a 30–35 pip retracement from the entry point).

Important: Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3394 level while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and trigger an upward reversal. A price rise toward the opposite levels of 1.3424 and 1.3465 can be expected.

Scenario #1: I plan to sell the pound today after a break below 1.3394 (red line on the chart), which should lead to a rapid drop. The key target for sellers will be 1.3349, where I plan to exit the shorts and immediately open long positions in the opposite direction (expecting a 20–25 pip rebound from the level).

Important: Before selling, ensure the MACD indicator is below the zero mark and just beginning its downward movement.

Scenario #2: I also plan to sell the pound in the event of two consecutive tests of the 1.3424 level while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and lead to a reversal downward. A drop toward 1.3394 and 1.3349 can then be expected.

QUICK LINKS