There are no macroeconomic events scheduled for Friday—not in the US, the Eurozone, Germany, or the UK. Therefore, even if the market were paying any attention to the macroeconomic backdrop, it simply doesn't exist today. The market continues to trade solely based on the "Trump factor." At the same time, the British pound can continue to rise without any apparent reason or justification.

There is still little point in discussing any fundamental events besides Trump's trade war. The dollar may continue to fall indefinitely if Trump keeps introducing new tariffs or raising existing ones. We recommend that traders pay close attention to public statements from key officials of major countries and alliances regarding tariffs. For example, the European Union has made minor progress in negotiations with the Trump administration. However, this "minor progress" is hardly enough to support the US dollar.

Trump himself has announced plans to introduce tariffs on semiconductors, which affect many countries around the world. The trade standoff with China remains unresolved, and it continues to be the market's top priority. In addition, Trump is once again pressuring the Federal Reserve to cut interest rates, even threatening to fire Jerome Powell—despite lacking the authority to do so. On Wednesday evening, the Fed Chair stated that lowering rates would require concrete macroeconomic justification, which is currently absent.

Both currency pairs may move in either direction on the week's final trading day. As we can see, the British pound is steadily climbing, while the euro is stuck in a flat range. The only potential source of news today is the White House. If no new developments emerge from Trump, the overall behavior of both currency pairs is unlikely to change.

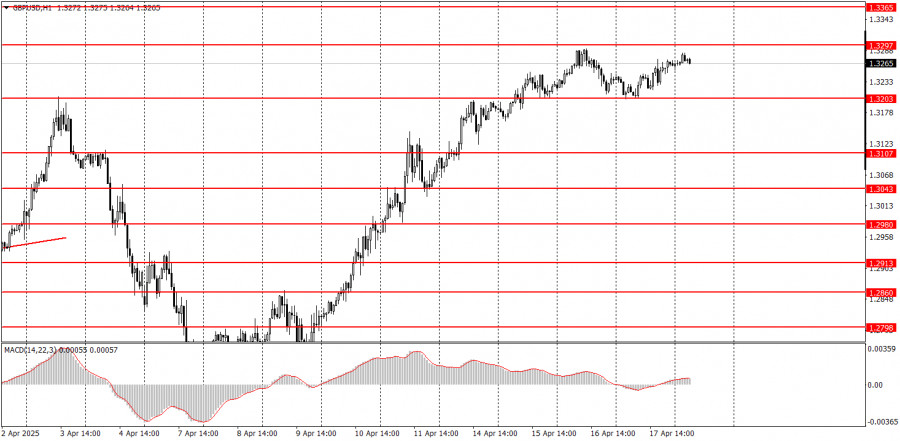

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

QUICK LINKS