A significant number of macroeconomic events are scheduled for Monday, meaning economic reports will greatly impact currency pairs. Business activity indices in the manufacturing sector will be released for the UK, Germany, the EU, and the US. Each of these indices holds its own importance; however, the US ISM index is expected to carry the most weight. Additionally, the EU will publish its February Consumer Price Index, an important economic indicator. Therefore, Monday is anticipated to be a highly volatile trading day.

In terms of fundamental events, nothing major is set for Monday itself. However, a key incident over the weekend could strongly influence the market. On Saturday night, a press conference was held at the White House with Presidents Trump and Zelensky. Unfortunately, the two leaders were unable to reach an agreement. The dialogue resembled more of an argument, and the deal they had come to Washington to sign was ultimately not completed. Zelensky left in frustration, and Trump immediately moved to block all financial and military aid to Ukraine. We believe this event could affect the forex market as early as the market opening, or during the Asian session on Monday.

Overall, both currency pairs are likely to continue declining on the first trading day of the week, as most factors suggest a downturn. However, traders should be cautious about potential market gaps at the open and high volatility during the Asian session. Throughout the day, economic reports will shape market sentiment, making Monday's movements somewhat unpredictable. Based on technical analysis, both the euro and the pound are expected to decline.

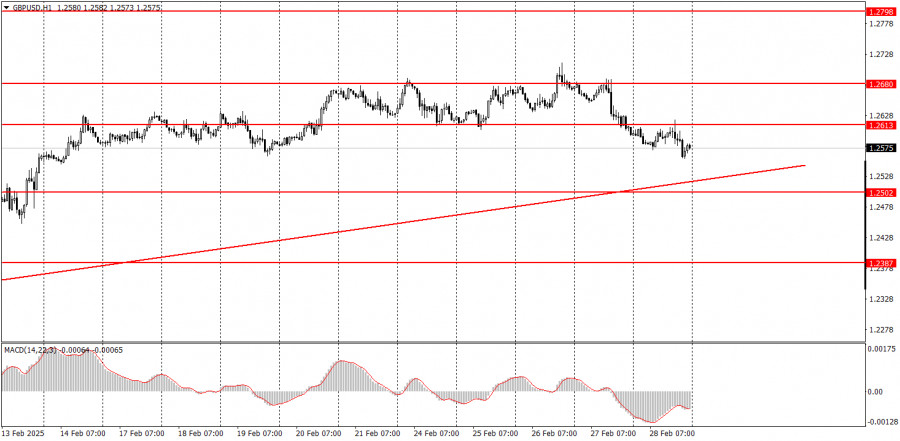

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

QUICK LINKS