The euro and the pound are continuing their upward movement, driven by the overall weakness of the U.S. dollar, which is facing pressure from disappointing fundamental data.

A significant drop in U.S. retail sales data last Friday led to a notable decline in the dollar, while boosting a variety of risk assets, including the euro and the pound. Investors, worried about a potential slowdown in U.S. economic growth, have been actively selling off dollar assets and shifting their focus to higher-risk investments. Expectations of further monetary easing by the Federal Reserve are reinforcing this trend.

The euro has gained additional support not only from capital outflows from the U.S. but also from positive GDP data, which has boosted confidence that the European economy may still manage to return to growth, despite recent interest rate cuts.

Today, a wide range of fundamental data will be released. Key points of interest include the eurozone's and Italy's trade balance, as well as the Eurogroup meeting and the Bundesbank's monthly report.

Closely examining the eurozone's trade balance will help assess the region's economic stability and identify potential risks associated with trade wars or a global economic slowdown. Similarly, Italy's trade balance data, especially in the context of its challenging economic situation, may provide valuable insights for predicting the future direction of the euro.

The Eurogroup meeting always attracts significant investor attention, covering key economic policy discussions within the eurozone, including budget policy, structural reforms, and potential stimulus measures.

The Bundesbank's monthly report typically provides a detailed analysis of Germany's economic conditions—as the eurozone's largest economy. This report is a key indicator for assessing the region's outlook and allows investors to adjust their strategies based on the latest data and forecasts.

The Mean Reversion strategy would be the best approach if the data aligns with economists' expectations. However, if the data significantly exceeds or falls below expectations, Momentum trading would be the optimal strategy.

For EURUSD

Buying on a breakout of 1.0529 may lead to euro growth towards 1.0567 and 1.0593.Selling on a breakout of 1.0485 may lead to a decline in the euro towards 1.0448 and 1.0411.

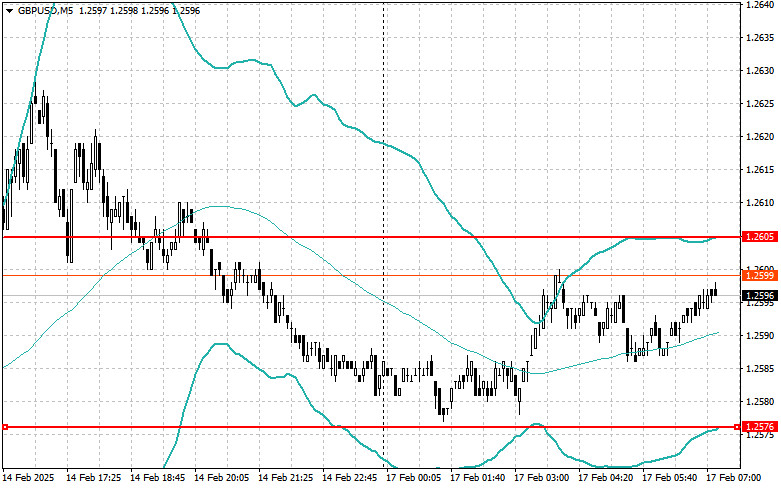

For GBPUSD

Buying on a breakout of 1.2627 may lead to pound growth towards 1.2664 and 1.2692.Selling on a breakout of 1.2580 may lead to a decline in the pound towards 1.2550 and 1.2515.

For USDJPY

Buying on a breakout of 151.73 may lead to dollar growth towards 152.10 and 152.42.Selling on a breakout of 151.35 may lead to dollar sell-offs towards 151.05 and 150.70.

I will look for sell opportunities after an unsuccessful breakout above 1.0511, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.0482, upon a return above this level.

I will look for sell opportunities after an unsuccessful breakout above 1.2605, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.2576, upon a return above this level.

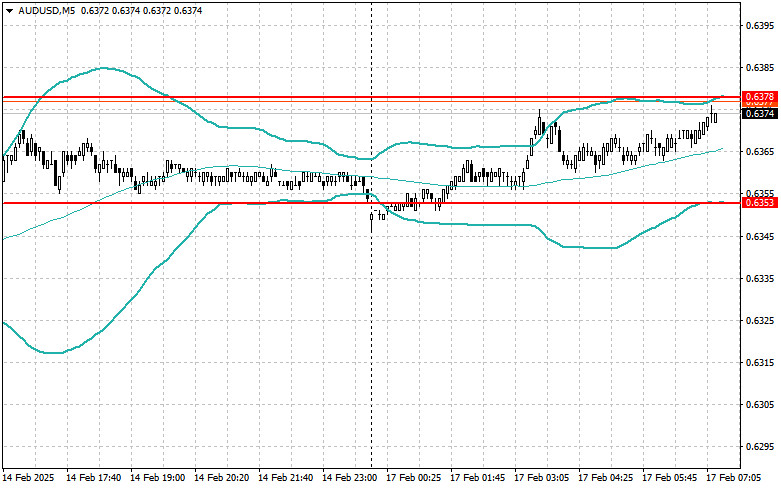

I will look for sell opportunities after an unsuccessful breakout above 0.6378, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 0.6353, upon a return above this level.

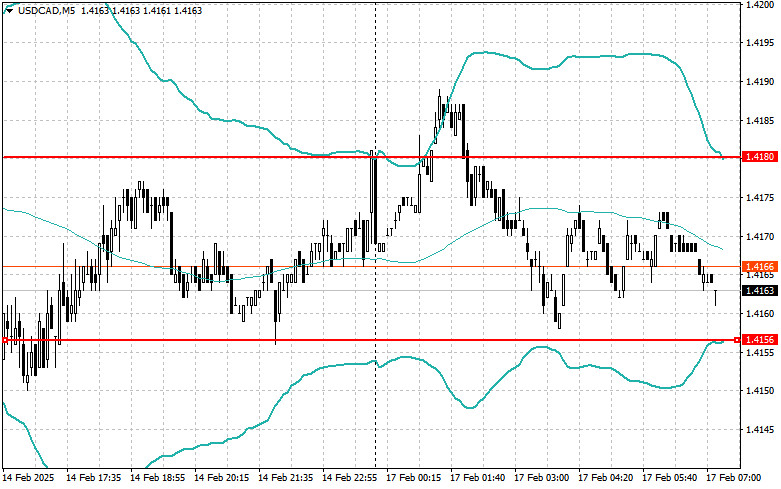

I will look for sell opportunities after an unsuccessful breakout above 1.4203, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.4172, upon a return above this level.

QUICK LINKS