Pokud si stále myslíte, že Ethereum je lepší investice než Solana, musíte si přečíst tento článek.

Za posledních deset let bylo Ethereum (ETH) jednoznačně jednou z nejlepších kryptoinvestic, které jste mohli udělat. V lednu 2016 se Ethereum obchodovalo za pouhé 2 USD, dnes se obchoduje za 2 700 USD. A zůstává druhou největší kryptoměnou na světě s obrovskou tržní kapitalizací 325 miliard dolarů.

Po deseti letech dominance však Ethereum možná ztrácí svou pozici. Solana (SOL) se stala hlavním konkurentem Etherea a nyní roste mnohem rychleji. Vše nasvědčuje tomu, že Solana nakonec sesadí Ethereum z pozice lídra trhu, a proto si myslím, že Solana je nyní lepší koupí než Ethereum.

Začněme porovnáním výkonnosti Solany a Etherea za poslední dva roky. Od 1. ledna 2023 vzrostlo Ethereum o zářivých 124 %. To není špatné, že? Podívejte se však na výkonnost Solany. Za stejné období Solana vzrostla o 1 872 %. To není ani zdaleka tak málo.

Jak vidíte z výše uvedeného grafu, koncem roku 2023 se výkonnost obou kryptoměn začala rozcházet. Od té doby Solana raketově stoupá vzhůru. V roce 2023 si Solana připsala více než 900 %.

Co tedy stojí za velkolepou výkonností Solany? Částečně ho lze vysvětlit tím, že Solana byla po implozi kryptoměnové burzy FTX v listopadu 2022 v podstatě ponechána napospas smrti. Solana měla vazby na zakladatele FTX Sama Bankmana-Frieda, takže investoři se Solany nechtěli dotknout ani desetimetrovou holí. Poté, co se Solana v roce 2022 ocitla na dně, neměla v roce 2023 kam jinam jít než nahoru.

Ale to je jen část příběhu. Je důležité si uvědomit, že jen na základě technických specifikací je Solana vynikajícím blockchainem 1. vrstvy. Zkrátka a dobře, Solana je levnější, rychlejší a efektivnější na používání než Ethereum. Má vyšší propustnost než Ethereum a také transakční poplatky jsou nižší.

To je silný recept na úspěch, jak upozornila Cathie Woodová ze společnosti Ark Invest (ARKK). V listopadu 2023 totiž otevřeně naznačila, že Solana má potenciál sesadit Ethereum z pozice lídra trhu.

Pozoruhodné je, že v listopadu 2023 se téměř přesně tehdy začaly výkony Solany a Etherea rozcházet. Možná to byl pro investory „aha moment“, kdy si uvědomili, že budoucnost patří Solaně, nikoli Ethereu.

Pokud se podíváte na nejnovější zprávu „Big Ideas 2025“ od společnosti Ark Invest, uvidíte, že Solana nyní překonává Ethereum téměř ve všech možných metrikách, které jsou pro blockchainy vrstvy 1 důležité. Z hlediska denních aktivních uživatelů, příjmů, počtu transakcí, celkové uzamčené hodnoty (TVL) a přijetí vývojáři nyní vede Solana, nikoli Ethereum.

Solana se navíc stala klíčovým hráčem ve světě decentralizovaných financí (DeFi). To je důležité, protože je to jedna z oblastí, kde Ethereum vždy bylo jasným lídrem trhu, a jedna z oblastí, která tvoří velkou část hodnoty Etherea.

Je pravda, že náskok Etherea v oblasti DeFi je stále obrovský, ale Solana se stala jasnou dvojkou. Ve skutečnosti, pokud se podíváte pouze na jednu klíčovou metriku – 24hodinový objem obchodů na decentralizovaných kryptoměnových burzách – pak Solana již Ethereum předstihla.

A není to jen podíl na trhu, který Solana Ethereu bere. Je to také „podíl na mysli“. Solana využila současný duch kryptoměn, což vedlo k přílivu nových uživatelů a nové aktivitě.

Stručně řečeno, Solana se napojila na meme coin kulturu. Investoři potřebují způsob, jak držet meme mince, obchodovat s meme mincemi a vytvářet meme mince, a Solana vytvořila pozoruhodný ekosystém, který to vše umožňuje.

V mnoha ohledech se „killer app“ pro Solanu stala Pump.fun, platforma pro meme mince, která uživatelům umožňuje vytvářet tisíce nových meme mincí každý den. Jediná blockchainová peněženka Solana (Phantom) si nyní každý den stáhne více uživatelů než populární aplikace pro sociální média.

Pozoruhodné je, že špičkoví vývojáři Etherea se konečně probouzejí a uvědomují si, že Solana v těchto dnech jí jejich oběd. Stěžují si, že jejich budoucí plán růstu je „příliš neambiciózní“, a někteří z nich upozorňují na nutnost přijmout novou strategii, která by Solanu porazila.

Vitalik Buterin, legendární spoluzakladatel Etherea, se k této otázce vyjádřil. Je přesvědčen, že pomalý a stabilní přístup k růstu Etherea založený na nekonečné řadě technických vylepšení je stále tou nejlepší cestou. Otevřeně si stěžoval na „degen kasinový“ přístup ke kryptoměnám, který zpopularizovala meme coin kultura.

Nemusíte rozumět ničemu o technologii blockchain ani o současném krypto zeitgeistu, abyste pochopili, jak moc Solana právě teď poráží Ethereum. Stačí se podívat na grafy. Investovali byste raději do kryptoměny, která za poslední dva roky vzrostla o 1 872 %, nebo do kryptoměny, která vzrostla o 124 %?

On Tuesday, the EUR/USD currency pair continued its upward movement, aligning with several key factors. First, a bullish correction is ongoing on the daily timeframe. Despite a market crash triggered by Donald Trump's actions over the weekend, the correction has neither ended nor been canceled. Secondly, there is a need to close the gap that formed on Monday. Additionally, Tuesday's macroeconomic data provided support for the euro. The sole report released that day—the JOLTs job openings—came in weaker than expected. While we don't consider this report particularly significant, the market is currently inclined toward growth, leading to increased buying of the euro. With numerous events and releases scheduled for this week, we anticipate high volatility for the pair. Nonetheless, we expect the correction to continue.

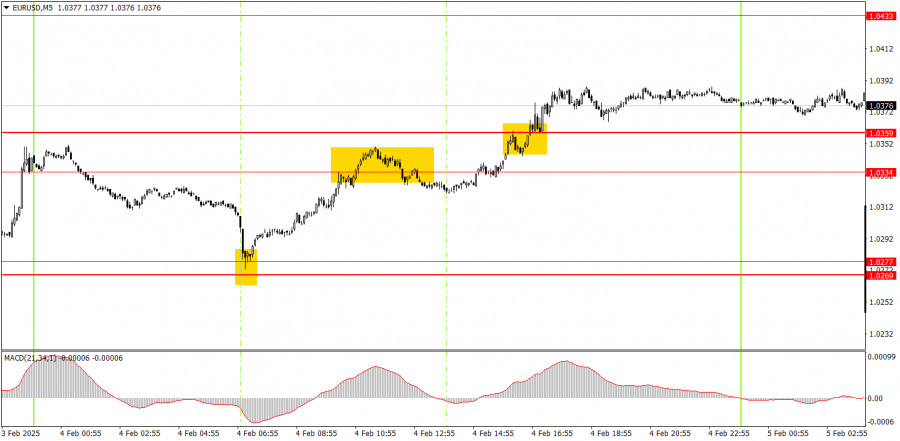

On the 5-minute timeframe, several interesting trading signals formed on Tuesday. At the start of the European trading session, the price rebounded from the 1.0269–1.0277 area and then rose to the 1.0334–1.0359 area. However, the rebound from this area turned out to be a false signal, resulting in a small loss from the short position. Shortly after, the pair broke through this area, which allowed novice traders to open new long positions. This trade was profitable if closed in the evening, although traders could also choose to carry it over to Wednesday. In total, two out of the three signals were profitable.

On the hourly timeframe, the EUR/USD pair remains in a medium-term downtrend. Although the local uptrend was briefly interrupted, it has since resumed. A decline in the euro is still expected, given that both the fundamental and macroeconomic factors continue to support the U.S. dollar. However, the bullish correction on the daily timeframe may persist for several more weeks.

On Wednesday, the pair's growth may continue, but one should focus on technical levels. The current rise in the euro is a correction, albeit one on a higher timeframe. On the hourly chart, this correction may appear complex, characterized by alternating trends.

On the 5-minute timeframe, the following levels should be noted: 1.0156, 1.0221, 1.0269–1.0277, 1.0334–1.0359, 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, and 1.0845–1.0851. On Wednesday, the services PMI indices will be published for the Eurozone, Germany, and the U.S. Notably, we should pay attention to the ISM Services Index in the U.S. and the ADP U.S. labor market report. Currently, the market indicates a bias toward growth.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

QUICK LINKS