On Friday, the GBP/USD currency pair experienced another decline. Among the macroeconomic data released that day, one notable highlight was yet another disappointing data from the UK. Although not a critically important report, we emphasize it because it contributed to a series of weak UK economic reports over the past week. Retail sales decreased by 0.3% month-over-month and increased by 3.6% year-over-year. In both instances, forecasts were higher, making these figures negative overall. Earlier in the week, the UK also released disappointing reports on GDP, industrial production, and inflation.

When discussing the inflation report, it is not appropriate to label it as "strong" or "weak," as that would be subjective. Rising inflation is favorable for the currency in the current context but detrimental for the economy and the central bank. Thus, we can say that December inflation in the UK was weaker than expected. What does this tell us? It suggests that the Bank of England (BoE) is likely to reduce rates faster than previously anticipated. Andrew Bailey stated in December that four 0.25% rate cuts were planned for 2025. However, following the December inflation report, there could be five or even six cuts.

We revisit the topic of interest rates at the Federal Reserve (Fed) and the BoE, as this continues to be the primary factor influencing the currency market. At the beginning of the year, the pound had already been on a downward trend for several months, adjusting to reach a fair value after the market had overestimated the easing of the Fed's monetary policy. It soon became apparent that the BoE would cut rates more aggressively than the Fed over the next 12 months. This provided a strong incentive to sell the pound for dollars. What better reason is there to sell pounds for dollars? A few weeks later, it became clear that the Fed might reduce rates only once, while the BoE could cut them more than four times.

The pound sterling has lacked reasons for growth, and the situation has worsened. The UK economy continues to stagnate, with macroeconomic reports consistently disappointing. A downward trend that has lasted 16 years remains ongoing, and the 3-month downward trend is still in place. Additionally, last week, the currency pair failed to stabilize above the moving average on the 4-hour timeframe. All indicators suggest that the British currency is likely to continue its decline for the foreseeable future. While a pause in this trend would be welcomed, it has not yet occurred.

Today, Donald Trump will officially take office as President of the United States, and this event could influence the currency market. While it is difficult to predict the exact effects, there may be an impact. Traders should be prepared for potential volatility in the markets, particularly with the EUR/USD currency pair. Friday closed near the lowest levels in two years. All of this suggests that the market is not preparing to start an upward correction.

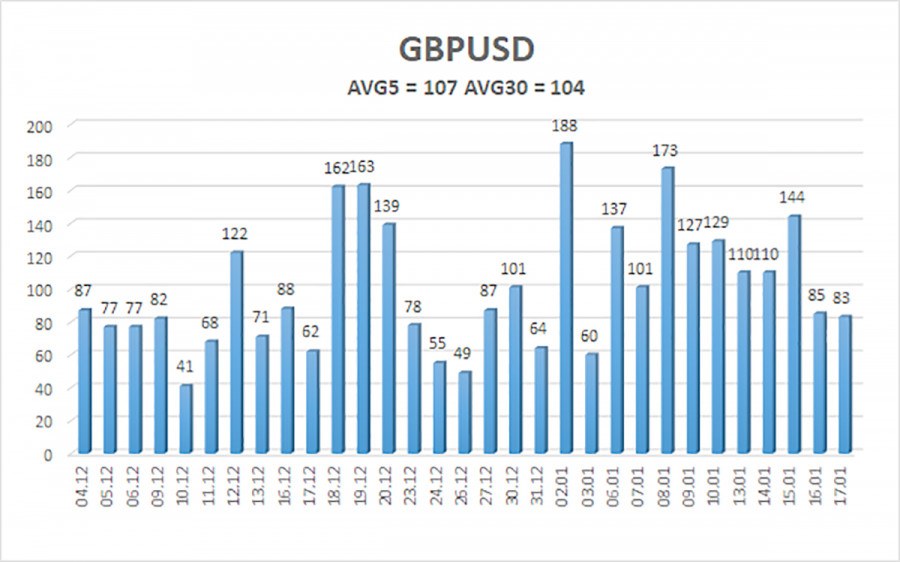

The average volatility of the GBP/USD pair over the last five trading days is 107 pips, which is considered "medium" for this currency pair. On Monday, January 20, we expect price movements to occur within the range defined by the levels of 1.2057 and 1.2271. The higher linear regression channel is currently directed downward, indicating a bearish trend. The CCI indicator has entered the oversold area once again. However, in a bearish trend, an oversold condition typically only signals a correction. Additionally, a new bullish divergence in the CCI has been observed, which suggests that the correction has likely already concluded.

The GBP/USD pair continues to maintain a bearish trend. We are not considering long positions at this time, as we believe that all factors supporting the growth of the British currency have already been factored into the market multiple times, with no new drivers emerging. For those trading based solely on technical analysis, long positions may be possible with target levels at 1.2329 and 1.2358, provided the price remains above the moving average line. However, sell orders remain more relevant, with targets set at 1.2085 and 1.2057.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

QUICK LINKS