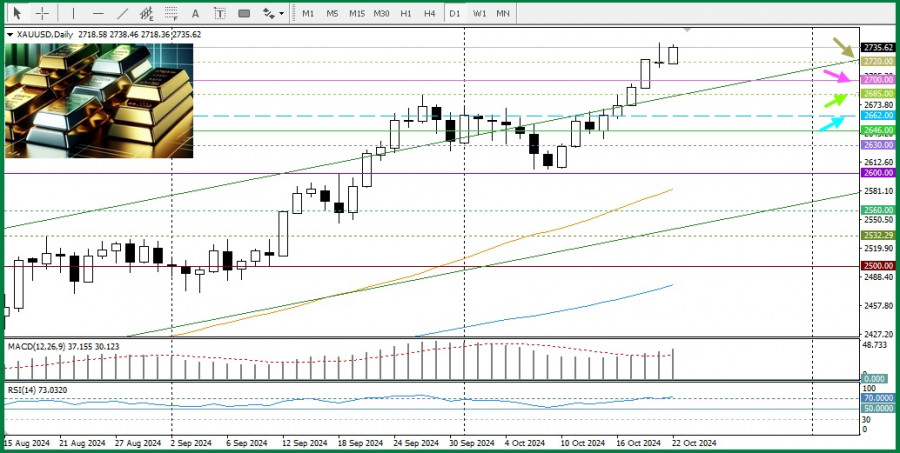

Today, gold maintains its intraday gains, hovering just below the recent high, attracting buyers on declines. Persistent geopolitical risks stemming from ongoing conflicts in the Middle East, uncertainty surrounding the US presidential elections scheduled for November 5, and the anticipated rate cuts by major central banks, combined with a modest decline in the US dollar, all serve as supportive factors for gold.

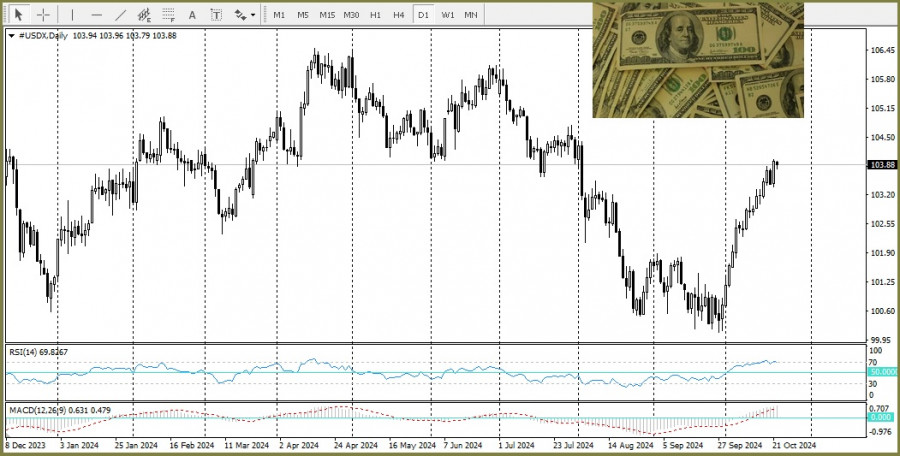

Additionally, expectations of a more gradual approach to monetary easing by the Federal Reserve have pushed US Treasury yields to their highest level in three months. This limits the corrective decline of the US dollar and, in turn, constrains the growth of the yellow metal amid its overbought conditions.

From a technical standpoint, although gold continues to attract buyers, the RSI (Relative Strength Index) on the daily chart is elevated, while on the 4-hour chart, it indicates slight overbought conditions. Therefore, traders with a bullish outlook should exercise caution.

Nonetheless, any corrective decline is likely to find support around $2,720. Following that, the next support level is $2,700, with further support expected at $2,685. This last support level will act as a key anchor point; a drop below it could accelerate the decline of the XAU/USD pair toward the previous resistance level at $2,662.

QUICK LINKS